Recent Market Sell Off 2025

The selloff is primarily based on a new administration's uncertainty about tariffs, potential earnings slowdown, and the fear of a recession, among other macro issues. My research shows that these fears will most likely not hold true, and I expect a complete recovery. The time frame will be determined. TLDR: HOLD!!!

We saw a significant market sell-off during the past few weeks. The S&P 500 is down almost 10% from its recent highs, and the Nasdaq 100 is in a 15% drawdown. Overall, SWCM clients underperformed during this drawdown, though we continue to outperform over a one-year and multi-year timeframe. This is a good time to add funds to your investment accounts.

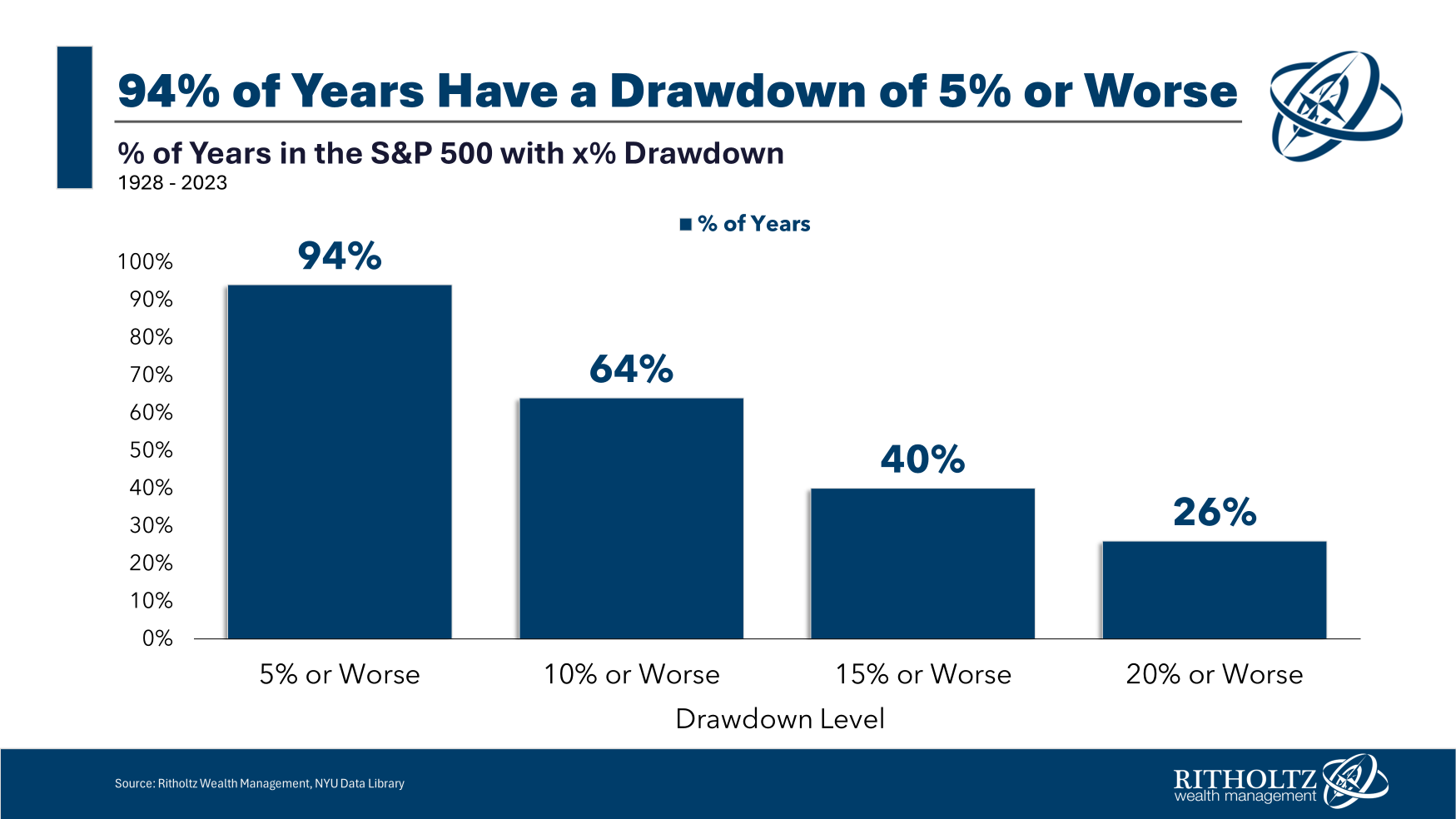

The market experiences sell-offs almost every year. There is a sell-off over 94% of the time. That said, we have always recovered. Chart 1

Chart 1

If anything, the current correction is weak based on historical and current macro data. It could get worse. I don’t know what will happen the rest of the year. A few weeks does not make a market. The S&P 500 is still up nearly 10% over the past year. It was up as much as 20%. It’s normal to experience a decent-sized correction, especially when the market has finished the past two years with solid gains—more data to follow.

This is more of a seasonal sell-off common in March. Chart 2

Chart 2

The S&P 500 has finished the year up double-digits in 56 out of 96 years since 1928 (almost 60% of the time). In 24 of those 56 years with double-digit gains, there was a double-digit loss at some point in the same year. That means nearly 45% of the time, when the stock market has been up 10% or more, there has been a correction of 10% or worse on the path to those gains. In all these past circumstances, we recovered with strong long-term returns.

More research notes will follow in the next few days. Stay tuned!

Disclaimer:

The information in this material is for general information only and is those of the author, not a recommendation or solicitation to buy or sell investment products. This material was developed and produced by James Sullivan, who is not affiliated with the named broker-dealer. Always consult a tax or legal advisor to review your situation comprehensively. Dollar-cost averaging will not guarantee a profit or protect you from loss but may reduce your average cost per share in a fluctuating market. Investors cannot invest directly in indexes. The performance of any index is not indicative of the performance of any investment. It does not take into account the effects of inflation and the fees and expenses associated with investing. A diversified portfolio does not assure a profit or protect against loss in a declining mark